Personal Finance: My FAMI Experience

Hi everyone. I just wanted to share my First Metro Asset Management, Inc. (FAMI) experience.

I sent my initial investment last Jan. 11 via one of the Metrobank branches. On Jan. 14, I emailed pictures of the documents I sent them (emailed twice, both they did not reply to acknowledge but I was not worried :)) On the week of Jan. 14-18, I made a follow up twice via call but did not get to speak to the one receiving the documents nor anyone in charge of processing the placements.

Made another call last Jan. 22 and luckily this time, I was

able to talk to the right person :). I was informed that my investment was

processed on Jan. 16 and that my Confirmation Receipt (COR) was picked up by Air21 last Jan. 21 :). I was happy to learn upon checking that NAVPS

were lower last Jan. 16 as compared to Jan. 11 when I submitted my docs.

On Jan. 23, my friend informed me that a package for me was delivered

to her place. I used my friend's address as my mailing address since I don't

have anyone to receive it in my apartment ( I live alone and my neighbours are

also renters, no landlady/landlord who can receive it for me) and based from my

readings in this forum, looks like the common problems are lost CORs. At least

in my friend's place, she's usually at home. I also inquired if I can just pick

it up from any Air21 branch closest to me but the guy said that's not an

option.

Things I did before my initial investment:

- Read and re-read the Mutual Funds (MF) threads here (I really went back to the old threads, which I have also read 2 or 3 years back :))

- Read some blogs about MF

- I know that I am an aggressive investor simply because my goal for my FAMI investment is long term. But just for the heck of it, I reassessed my investor profile based on BDO's questionnaire for their UITF investments (got it from their website). FAMI's form also has a questionnaire but the grading is not available though

- Browsed through the FAMI site mainly to check on how to invest with them. Honestly, until now, I haven't yet read the Save & Learn Equity Fund (SALEF) prospectus and that's Step 1 of their procedures hihihi. Still in my to-do list :)

- This is out of my budget but since I really wanted to kick off my FAMI journey, I set aside part of my 13th month to fund this and the amount required to open a Metrobank account, which brings me to...

- I opened a Metrobank account so that future top ups will be online (just because I'm a sucker for online transactions as long as I know it is secured hehehe). I'm not sure yet what to send to FAMI if I top up online. I'll share with you after my actual experience :)

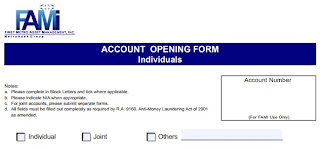

- I took my time in filling up the forms (Account Opening Form (AOF), Investment Application Form (IAF), and Signature Cards). I think it took me 3 days before I was at ease with all the information I placed in the forms. I even Googled all terms I did not understand and there were a lot of them because Finance is not my field. Thank you Google hihihi.

My inital investment was just the minimum of Php5K for SALEF. Based on my COR, I was deducted Php100.00 for Sales Load.

Was it hard or complicated? Not really. I just followed the FOUR steps in FAMI's website (there's a mistake in the step numbers so you'll see until Step 5 :D). I did not have an agent but it actually crossed my mind to have one at first. I also did not call FAMI beforehand to inquire because the information I got from the forum and blogs were more than enough for me to go with it. However, this does not work for everyone. As a general rule, it is still best that you do what would make you comfortable before diving into this. But don't wait or delay too long (like what I did) because as Financial advisers would always say---the time to invest is NOW. :)

May I just note (based from experience) that looks like most bank tellers are not familiar with these so you must research well before talking to them because do expect that you'll be the one giving them instructions on simple things such as pouching your documents to FAMI :D.

Happy investing!

Labels: Investment, Personal, Personal Finance

2 Comments:

Interesting investment option. Thought I'd start with philstocks, but this one sounds more viable for me.

@Francis--FAM! hahaha. ay kamusta naman yung ngayon lang uli ako sumilip dito :p. go! mababa stocks ngayon (if equities or balanced funds ang choice mo) so mas mabibili mo sya ng mura hahaha. I'm going into stocks in a few days hehe. attending a seminar by COLFinancial this Thursday!

Post a Comment

Subscribe to Post Comments [Atom]

<< Home